Microfinance initiatives can play an effective role in addressing material poverty, the physical

deprivation of goods, services, and the income to attain them. MFIs can help people become

more economically secure.

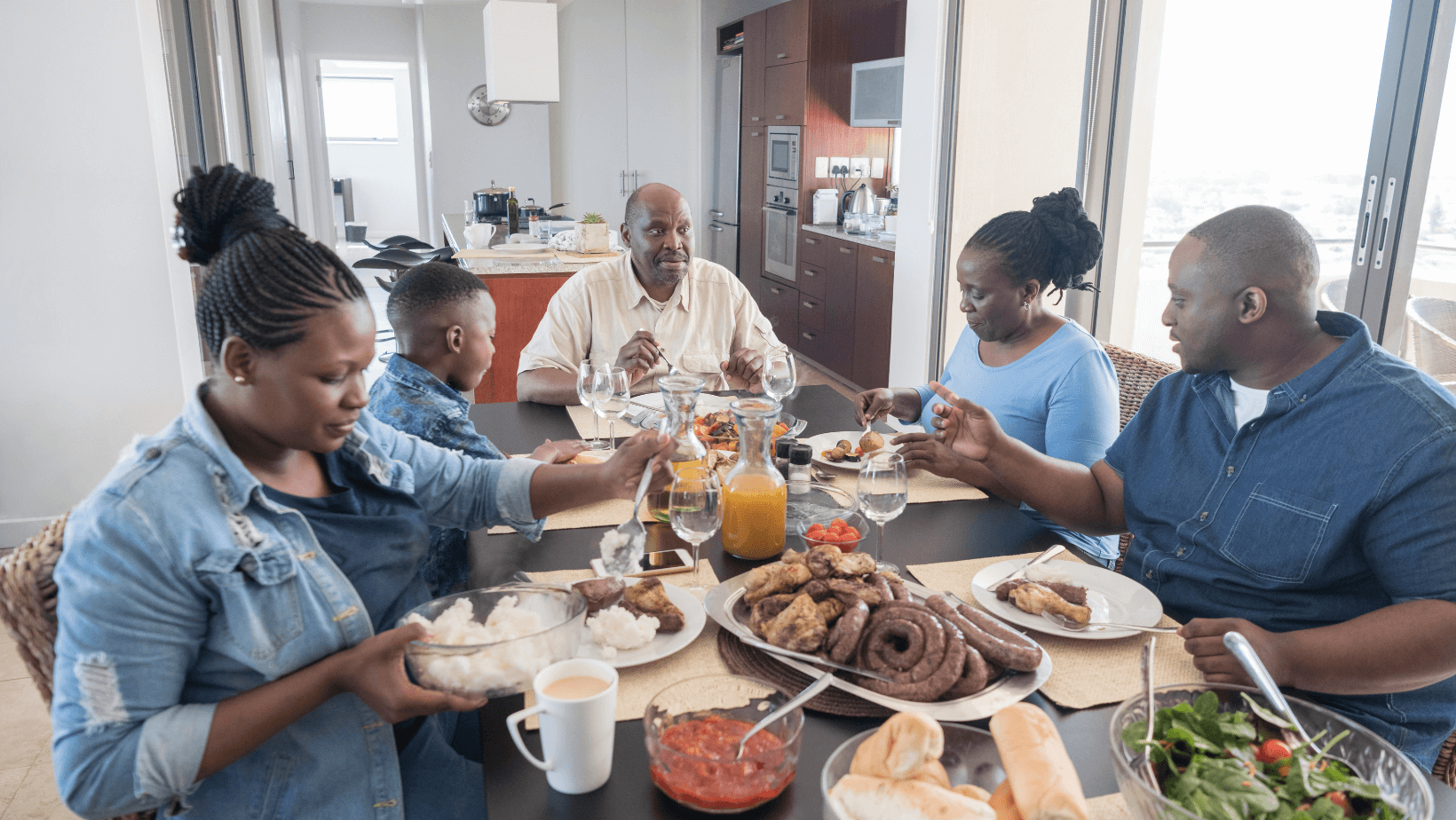

This, in turn, has a multiplier effect on people’s standard of living, enhancing basic household

welfare, such as food security, nutrition, shelter, sanitation, health and education services.

MFIs can help prevent and extricate people from debt. Oftentimes, they liberate low-income

households from moneylenders with outrageous interest rates that often reach 100% annually.

Savings and credit services help people start or improve their own small businesses, providing

income generation and employment for themselves and their families.

Credit can be used as working capital so that clients’ efforts become more productive; for

example, clients can buy rice or grains in bulk at wholesale prices and resell it at retail prices

or buy a refrigerator to keep produce fresh. As clients become more productive, their income

increases, and they are able to accumulate savings for other investments and emergencies.

Savings serve as reserves for important household expenditures (such as school fees and

funeral costs), and as insurance against sudden crises (such as illness, natural disaster, or

theft) that can otherwise result in destitution for people already living at the poverty line.

In many cases low-income people want to save and have been saving in a variety of traditional

ways, ranging from kinship networks to Revolving Savings and Credit Associations (ROSCAs),

but lack appropriate saving facilities that offer a combination of security of funds, liquidity,

positive real return, and convenience. MFIs can build upon Africa’s traditional savings ethic to

enhance outreach and quality of services. It is important to keep in mind that for any financial

service to have a lasting impact on poverty eradication, it must be flexible and innovative to

adapt to their needs of its clients..

CAUTION: Borrowing more than you can afford to repay can lead to severe financial difficulties.

Article Extract Credit: MICROFINANCE IN AFRICA – the United Nations

Article Title: Microfinance in Africa: Combining the Best Practices of Traditional and Modern Microfinance Approaches towards

Poverty Eradication

_____________________________________________________________________________________________________

Calgagovski J., V. Gabor, M.C.Germany and C.Humphreys 1991. “Africa’s Financing Needs in the 1990s” in I.Hussain and J.

Underwood (eds), African External Finance, World Bank, Washington D.C.

https://www.un.org/esa/africa/microfinanceinafrica.pdf